Past Week

“Understanding and Navigating Markets is as much Art as it is Science”

Here’s a snippet of our plan; “Buyers’ first task will be to continue OTFU on the Daily and hold above 16,024/42 and target 16,080 and 16,122/55, where the next decision is made. Upon acceptance above targets 16,234/55 (Gap) followed by 16,332/55 (Single Prints) and 16,409/427 (Balance Top).” 💯

Balance rules were at the fore front and that high tempo push inside Balance (16,017 - 16,427) was the first indication of market participants accepting into higher Balance, while an entry based on Gap Rules was possible on Wednesday but a tad bit too quick. Thereafter, 16,122/55 provided us with textbook LIS Long Confirmation and one that helped us participate in a +272 Points rally - rotation to the Balance Top.

Weekly Plan

After the opening drive higher/high tempo breakout into the prior Balance, Friday ended with a Spike up (Spike Base 16,369), resulting in DAX ending the week by OTFU on the Daily (Ends at 16,276) and Weekly (Ends at 15,914). It is noteworthy that an identical run was seen back in July (28th - 31st) within the same Balance Range.

For the week ahead, the central focus will be on 16,335/52 and if buyers can hold on any pullback that’s seen next week. The confluence around this zone makes it an important level to track; Friday’s IBH + US ABPL and right above is Spike Base. Alongside, we’ll observe the prior Balance Range (16,017 - 16,427).

Balance Rules

Extreme ends of a Balance are Support/Resistance, unless proven otherwise. In the event of a Balance Break, look to follow the trend and target 50% and then 100% of the range Extension, unless you have a 'Look Above/Below and Fail', which means you are then targeting the Balance Halfback and the extreme other end

‘Buyers’ first task will be to continue OTFU on the Daily and hold above 16,335/52 to then target 16,408/27 followed by 16,462/81 and 16,527/42 where the next decision is made. Upon acceptance above targets 16,583/606 and 16,636/66. It is to be noted in the event a defense is seen at Friday’s Spike we’d want to favor buyer control and apply Spike Rules.

On the other hand ‘Sellers’ first goal will be to get back below 15,335 (Friday’s IBH), which initiates an IB rotation down to 15,263/74 (Gap/Friday’s IBL) followed by 16,216 and 16,166/69, where the next decision is made. Upon acceptance below targets 16,127/42 followed by 16,072/89 and 16,017/42 (Balance Low/Pivot). Maintain the awareness that dip buyers are likely to be active at KEY Points.

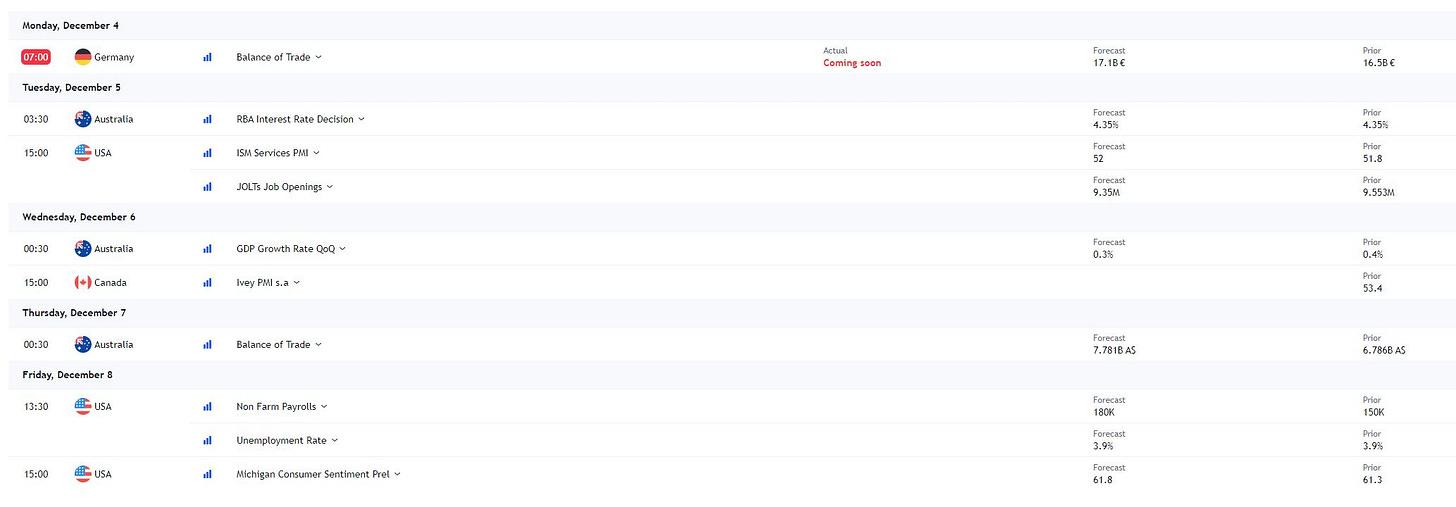

In the weekly charts below, we have highlighted the anchor balance ranges to monitor that will help us better understand the weekly auction and rotation. Likewise, Zones of Interest, Weekly Support/Resistance and annotations makes us aware of the areas of interest. In terms of events, ISM on Tuesday and NFP on Friday may result in volatility. It would be prudent to maintain situational awareness before initiating trades.

Weekly Targets

Upside: 16,462 | 16,527 | 16,582 | 16,636 | 16,680

Downside: 16,352 | 16,264 | 16,216 | 16,166 | 16,127

EdgebyRS Discord

If you've enjoyed our Weekly Content and are eager to delve into a similar comprehensive daily plan, we've got you covered with additional valuable resources, such as:

First 60-90 minutes: Live Trading with a distinctive feature - You learn my "Thought Process" and strategies during this time.

Well-defined Trade Zones supported by a Time Tested Execution Framework.

Tailored one-on-one support and regular review of trade journals.

To join our Discord community, visit www.108altitude.com

Economic Calendar

Wish you all a fantastic week ahead! :)

Where can we learn about the acronym that you use sir