Welcome to EdgebyRS

Introduction to EdgebyRS The first question on everyone’s mind “How can EdgebyRS help me in becoming a better and profitable trader?” Here’s brief about me and my approach... In my 12 year trading career, I have experienced and learnt that in the realm of trading borrowed confidence has its limit. At some point, you must build your own, or else fear an…

Market Prologue

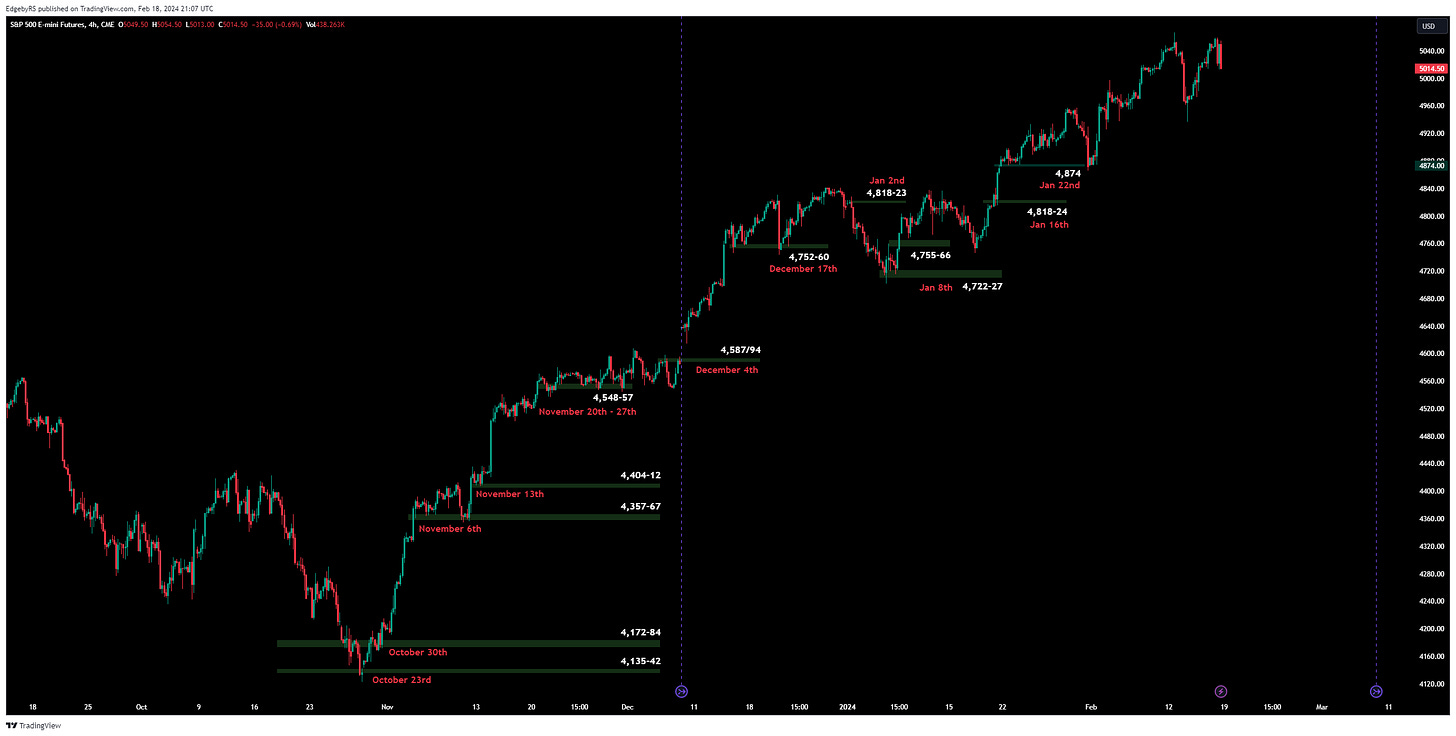

Since the October lows, accurately identified on October 23rd, 2023, ES has maintained an upward trajectory, culminating in a rally of approximately +22% over the past four months. While the Macro Outlook is a recent addition, our Weekly Plan has consistently guided our readers to the right side of this rally. To further illustrate, here's a brief overview of how our "Support/Buyer Zones" have unfolded over the past 16 weeks – feel free to back-test our Weekly Plans.

This chart exclusively showcases the "Long" Zones identified between October 23rd, 2023, and January 26th, 2024. Each zone was activated, facilitating confident participation in this upward move of over +900 Points. It's worth noting that while we did implement tactical fades during the ascent, the primary trades consistently remained on the long side. The results for February are equally remarkable, and a comprehensive review is covered in our Weekly Recap.

Our achievements result from our ability to perceive the markets through a unique lens. This entails collectively considering the following elements:

Essence of the Structure - Recognizing that every coin has two sides.

Balance & Imbalance

Importance of Events

Character of the move

Sectorial Study

Timing, Seasonality & Sentiment Analysis

Secret Sauce

The ongoing uptrend from the October lows at 4,125 to last week's peak at 5,067 has resulted in ‘Shock n Awe’ to many market participants. This is primarily rooted in the fact that ES had been range-bound for two years, and psychological influences played a significant role. In contrast, we relied on our time-tested elements to stay on the right side of the market. It prompts us to question the merit of a strategy or model that advocates continuously shorting a rally that consistently achieves all-time highs every week.

We acknowledge that being wrong is an inherent aspect of the process; however, choosing to remain wrong is always within one's control. With this perspective in mind, we will discuss the signs indicating that an interim exhaustion is approaching, along with the evidence we are actively seeking that will pave the way for a tactical pullback.