$ES Weekly Plan - 16th Feb'26

It is sellers game to lose.

🚀Live. Full Throttle. Let’s Roll

EdgebyRS Discord is open again.

If you want real time guidance, live reads of developing structure, and clarity on what each move means —> this is your window.

The room is active. The work is sharp. Step in and level up. 💪

📅ES Weekly Reflective Study

🧭 Market Structure Overview

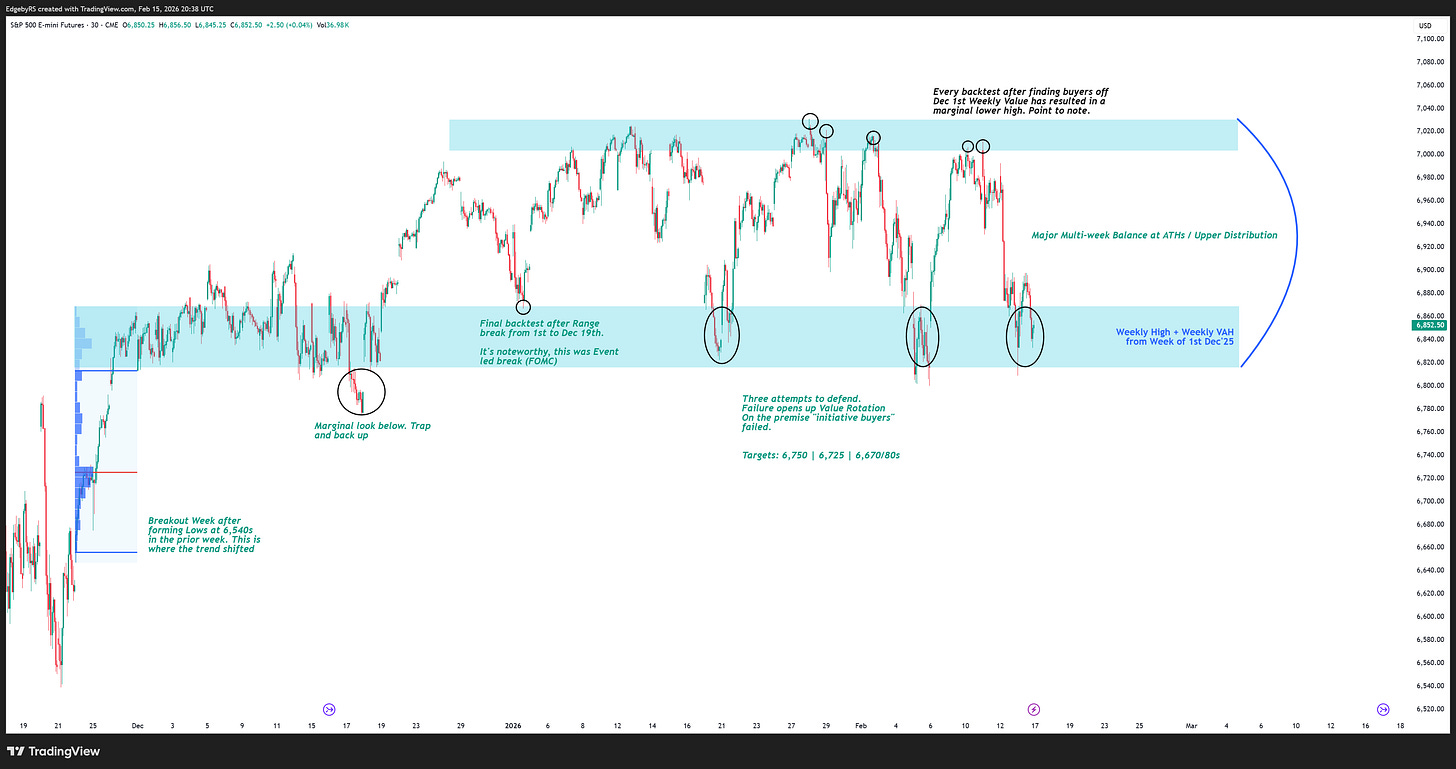

Daily: OTFD (Ends at 6,898)

Weekly: 8WK Balance (6,801 - 7,031)

Monthly: Balance

What Happened Last Week

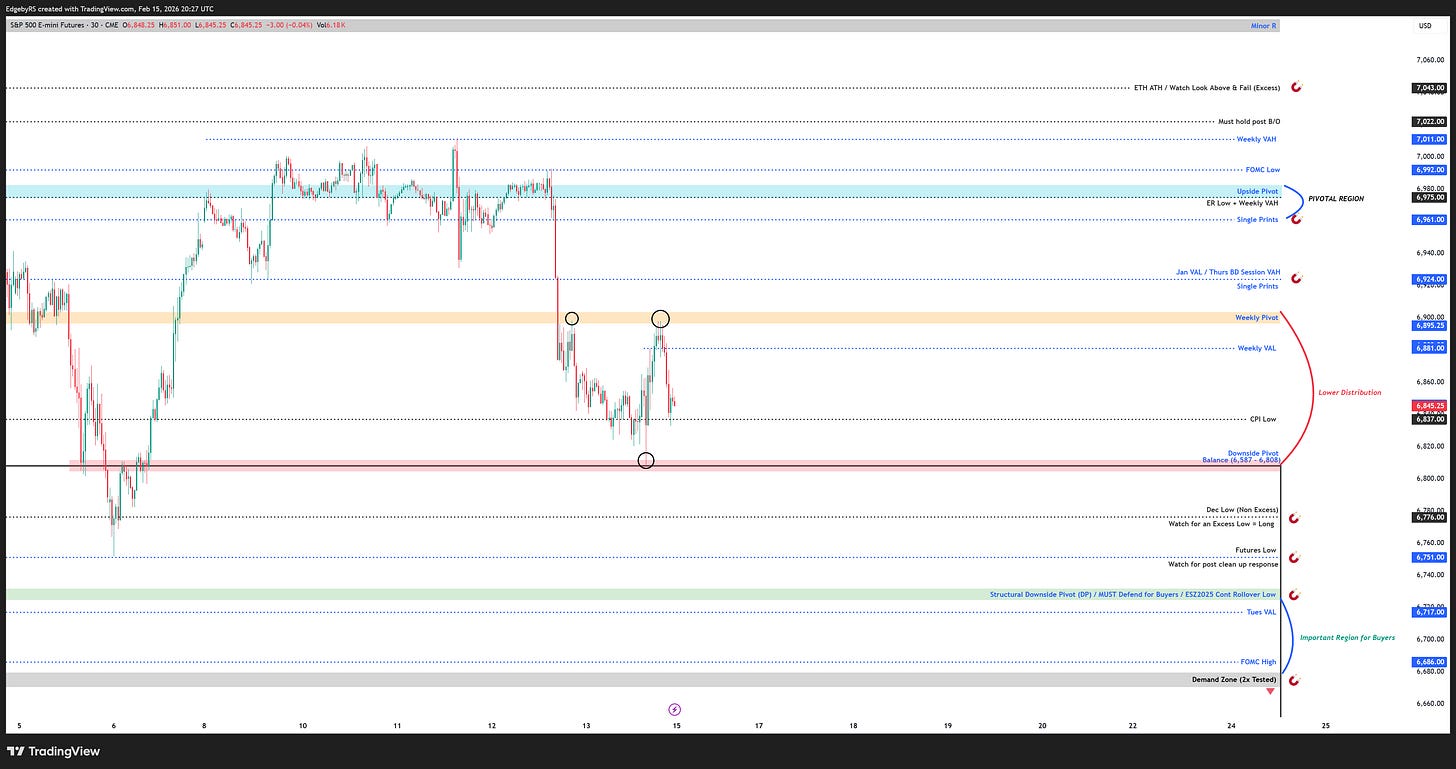

ES opened the week at Friday’s Upper Distribution, defending Friday’s VAH and January VAL at 6,924. Buyers immediately took control and initiated an opening drive higher, rotating price back inside January’s upper distribution, Weekly Pivot, and Weekly VAH around 6,975.

The advance, however, stalled as initiative buyers failed to find traction following the NFP release. This lack of follow through triggered a liquidation break, ultimately completing the rotation back into prior Friday short covering rally range low. The move culminated in an excess low at 6,808, which also marks the Balance Top, before the week ended near Friday’s open and within Thursday’s lower distribution.

The breakdown was driven by three primary factors:

• Lack of traction post events, specifically NFP.

• Failure of the prior Fri short covering rally to find continuation beyond 2 sessions.

Structural Outcome & Way Forward

The late week liquidation followed by Friday’s acceptance within Thursday’s lower distribution confirms that ES remains firmly inside its multi week balance, although on a weaker footing. Two key structural developments now stand out.

First, Thursday ended with a Double Distribution to the downside. This marks the first meaningful structural shift seen in recent weeks. Historically, such downside shifts have been followed by sharp moves higher. This time, however, Friday did not reclaim the structure and instead held inside Thursday’s lower distribution, effectively establishing a Double distribution on the weekly profile too.

Second, within this balance, ES has now printed three consecutive lower lows without cleaning up the ETH ATH. This introduces developing weakness unless buyers reclaim and sustain Friday’s high early in the week. The only nuance to be aware about is the ‘lack of excess’ at Friday’s High, which suggests a revisit back cannot be ruled out, neither a look above and fail. A successful reclaim would likely initiate another V shaped recovery targeting Thursday’s poor structure near 6,960.

Failure to do so, or a look above and fail of Friday’s high, increases the probability of an initial RTH move below 6,808, opening the path toward 6,751 and 6,725. Sustained weakness below these levels could result in multi week trapped inventory above 6,905.

The broader 8WK balance continues to compress into a major coil, with a projected expansion of 316-351 points once a directional break occurs. Early clues of weakness emerge on sustained acceptance below 6,896 to 6,904, while strength remains defined above 6,974 to 6,983. Any resolution from this balance is likely to be characterized by London range migration, value migration, opening drive behavior, OTF development, or a gap open.

What Else Matters

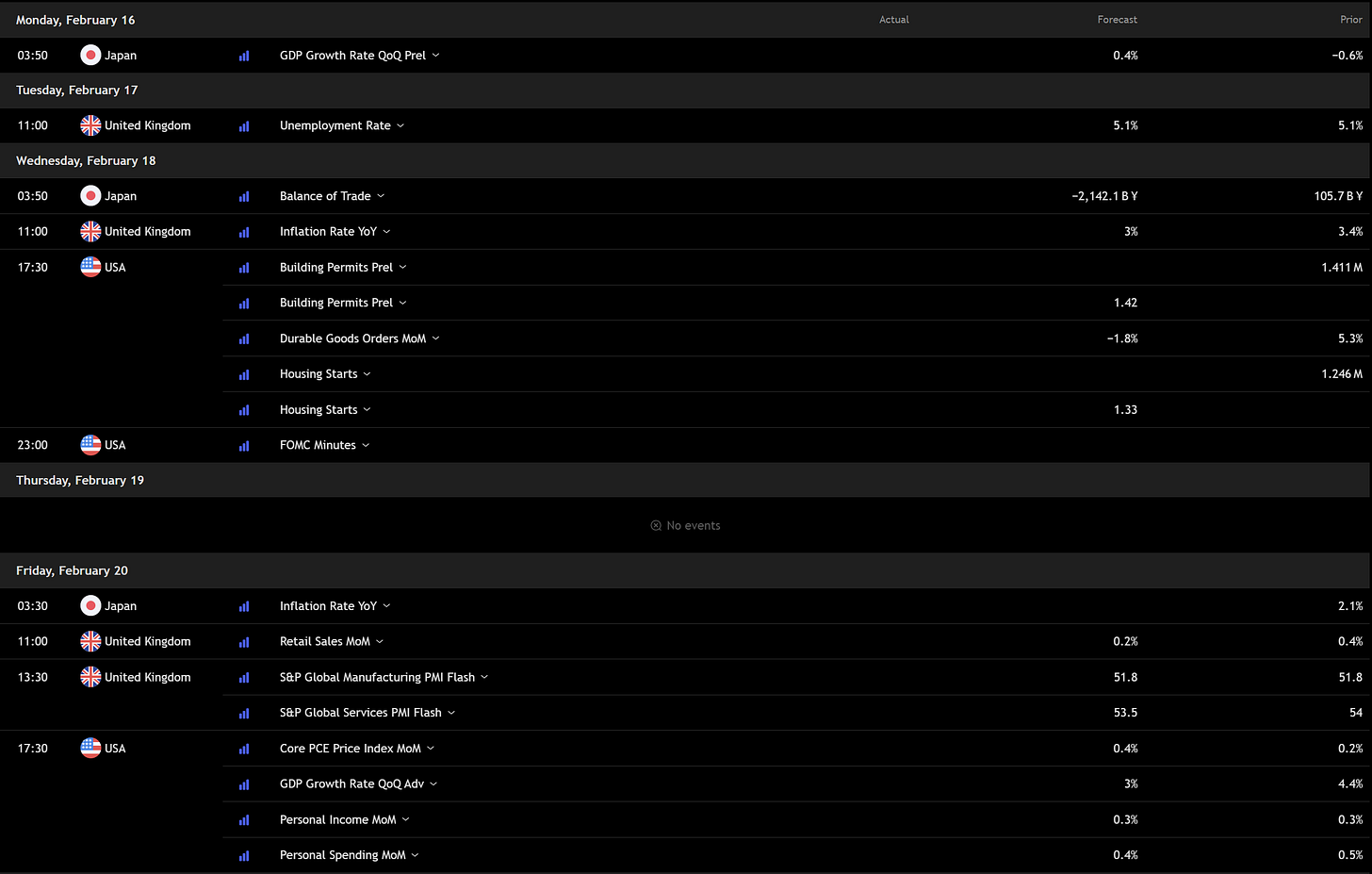

With major earnings now behind us and a holiday shortened week with no major economic event except PCE release on Friday, ES is likely to be guided by Friday’s Edges, which find major confluence to ultimately guide on a intraweek directional move.

For the week ahead, the auction will primarily be governed by:

• Downside: 6,804-6,812

• Structural Repair: 6,894–6,904

Upside resolution:

6,924 → 6,961 → 7,043

Downside resolution:

6,776 → 6,754 → 6,725 → 6,686

📖 Weekly Plan

🎯 Weekly Pivot (WP): 6,896 – 6,904

This zone aligns with:

Friday’s High

Thursday + Weekly Lower Distribution

Prior Friday’s B/O Session VAL

📌 Buyer Playbook

Holding 6,896 - 6,904 (Weekly Pivot)

Reclaim above the Weekly Pivot (WP) initiates recovery and targets:

6,924 (Jan VAL)

6,960 (B/D Session top of Single Prints - V shaped recovery completes here.)

6,974/83 (Event Low + Upside Pivot, Structural Shift)

Upside Pivot must reclaim LIS 6,992 to validate initiative buyers

Further upside initiates on acceptance above 6,974/83-92 (Structural Shift)

7,037/47 (ETH ATH, Watch for Excess post clean up)

7,077/86 → 7,108/24 (Minor Resistance + LIS)

7,144/64 (Resistance/ Exhaustion)

📐 Rotational Playbook

Lack of traction above Friday’s high or a look above and fail (lack of excess at Friday’s High) triggers a rotation lower.

Targets:

6,837/46 (Friday VAL + CPU Launchpad)

6,804/12 (Weekly Low + Balance Top/Downside Pivot)

💡Pro Tip:

The decisive move is likely to emerge either in the upcoming week or the one that follows. It is paramount to observe whether the 4th test below 6,896–6,904 finds downside traction. Failure to do so increases the probability of an aggressive move higher.

📉 Seller Playbook

Buyers may attempt one more defence at 6,804/12 and must reclaim 6,837 or else weakness continues. Failure unlocks downside move targets;

6,776 (Dec Low + Holiday season launchpad)

6,750 (Untested Overnight Low; Watch for Excess Low)

Weakness continues below, targeting:

6,712/27 (ESZ Contract Low + Support)

6,670/86 (Demand Zone + 2nd Support)

💡Pro Tip:

Such a move would place ES back inside the value area of the week of 1st December (6,646–6,813). This is a critical reference, as it represents the original breakout week and thus explains the defence battle each time ES has taken a trip down here.

🧠RS Insights

The last 6 weeks we have revolved around two core themes; V-Shaped recoveries and Event acceleration or lack of. Both have delivered. Last week was a phenomenal example of the latter. When events fail to accelerate, short term participants are forced to liquidate. Both NFP and CPI did exactly that, printing new session lows on the day of the release.

What stood out even more was that every leg lower respected the same structural zones we have carried forward since January: 6,894–6,904 and 6,975–6,983. These continue to guide the auction with precision and, in our view, remain critical for any multi week directional move that is developing. This is not coincidence. It is character. And we remain confident these two themes will continue to define the auction for the foreseeable future. It is not too late to study this behaviour.

Short term sellers are now active. Each pullback high formed at structural zone, and every breakdown found sellers stepping in at predefined levels. This points to responsive participation rather than emotional selling. The origin of the recent rally was the overnight low at 6,750. Over the past few weeks, we have observed rallies that originate from overnight extremes have been revisited within two to three weeks. The odds of that pattern repeating remain favourable, particularly as long as Friday’s high continues to cap the auction.

V- Shaped Recovery & its Nuance

We do not rule out another V-shaped recovery, especially with two sets of single prints left overhead. However, our preference is for that move to initiate only after 6,750 is cleaned up, followed by a measured test of either 6,725 or the 6,670–6,680 region. These targets would align with the typical pullback magnitude of around 5% that often precedes a clean up of an untested ETH high. That said, awareness comes first. Friday’s high will guide whether a change in control is underway next week and a repair work initiates towards 6,961.

Balance ATH & its Nuance

The next leg is likely to emerge as early as next week or the one after, the move that finally resolves the current balance and initiates a trend.

Fresh initiative buyers remain notably absent. ES is now sitting in a nine week balance at ATH, an environment that historically behaves very differently. ATHs typically feature persistent initiative buying with shallow pullbacks. This time, we’ve already seen three separate +200 point drawdowns, a clear shift in character. That’s one reason why any new highs are likely to attract sellers and trigger liquidation breaks unless supported decisively by events or gaps.

Why were we confident to Short at 7,008, 6,975, 6,892 and Long at 6,808?

The logic was straightforward. When events fail to build on an already bullish structure, the structure itself becomes vulnerable. We highlighted this last week, and the market respected that character again. With NFP failing to deliver sustained traction, we initiated shorts at 7,008. The subsequent LIS Framework Short at 6,975 provided the second layer of confirmation, strengthening conviction as the prior Friday short covering rally had already failed to find meaningful buyers.

The long at 6,808 was driven by Balance Rules. Balance Top sat at that level, and the zone found confluence with the prior week’s RTH low and value. The key principle remains unchanged: always identify the source of the move. When that base is retested after time and after a meaningful response, the reaction is rarely random.

Preparation mattered. And once again, it paid.

The plan outlines what the market is likely to do.

These insights exist to prepare, not to bias.

They sharpen awareness so that when the pattern truly emerges, execution is cleaner, confidence higher, and decisions grounded in structure over opinion.

Structure First. Levels Decide. Events Accelerate.

📘 Balance Rules

The extreme ends of a Balance act as support or resistance unless proven otherwise. In the event of a Balance Break, follow the trend and target 50% and then 100% of the range extension, unless there is a Look Above or Below and Fail, in which case the target shifts to the Balance Halfback and then the opposite extreme.

In the weekly charts below, we have highlighted the anchor balance ranges to monitor, which will help us better understand the weekly auction and rotation. Likewise, the zones, weekly support and resistance levels, and annotations highlight the key areas of interest.

Keep an eye out for a potential volatility trigger on Friday (PCE) in an otherwise light data week. We suggest maintaining prudence and situational awareness before initiating trades.

🗺️Weekly Zones

🎯Pivots & Targets

Weekly Pivot: 6,896/904 | Upside Pivot: 6,974/83 | Downside Pivot: 6,804/12

Upside: 6,924 | 6,960 | 7,043 | 7,077 | 7,108

Downside: 6,774 | 6,750 | 6,725 | 6,686 | 6,612

Economic Calendar

Earnings Calendar

Clarity First / Action Next.

Wish you all a fantastic week ahead! :)

Thank you RS as always for sharing your work!